The staff report for the Mill Valley City Council’s Dec. 4th hearing couldn’t have been stark: “Our City’s infrastructure is at risk for significant decline within the next 15 years. How will the City secure funding to address needs such as minimizing the risk of wildfires, repairing and maintaining local streets, roads, parks, and facilities, and addressing flooding issues in order to improve sustainability, emergency preparedness, and accessibility?

The staff report for the Mill Valley City Council’s Dec. 4th hearing couldn’t have been stark: “Our City’s infrastructure is at risk for significant decline within the next 15 years. How will the City secure funding to address needs such as minimizing the risk of wildfires, repairing and maintaining local streets, roads, parks, and facilities, and addressing flooding issues in order to improve sustainability, emergency preparedness, and accessibility?

These are issues facing every municipality in the Bay Area and beyond, and city officials appear determined to get out in front of it.

What does that mean? To date, starting in July 2023, the city has leveraged a “temporary subcommittee” of 15 Mill Valley residents to bolster the efforts of the city staff to identify a path forward. The Committee was tasked with reviewing City finances, infrastructure reports, exploring funding options, and providing recommendations to the Council. The Committee held five public meetings from September to November 2023 and worked to produce a Report and Recommendation, which they presented to Council on Monday, December 4. The committee was chaired by Jim Parrinello and Jerry Cahill.

Parrinello told the group that an assessment of the City’s financial strength indicated that the City is financially stable with healthy general fund reserves. “The bottom line is, the City’s operating very well,” Parrinello said. “From a financial point of view, that will be important as next steps are taken.”

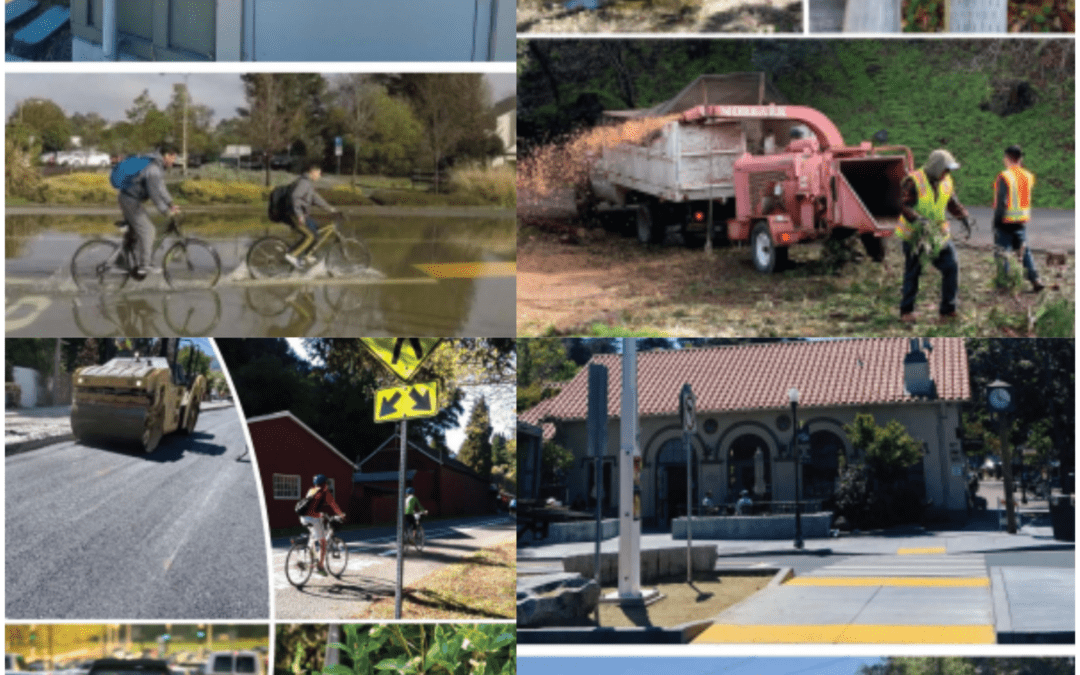

A detailed presentation from the City’s Public Works Department followed, outlining infrastructure needs in various areas, such as wildfire prevention and evacuation, streets and sidewalks, storm drains and flood-prone areas, bridges and culverts, roadway and hillside stabilization, City facilities, parks and playgrounds.

Parrinello shared that the City “demonstrated, pretty clearly, that the infrastructure needs over the next 15 years will represent repair costs in the range of $150-$180 million, and the City budget does not have enough extra money to fund all that. This is not something that staff sent us and said, ‘Here, take our word for it.’ We went through some very detailed reviews of studies with them, and we came away convinced.”

Over the next two meetings, the Committee vetted several revenue options from NHA Advisors narrowed their discussion to two options: 1) Documentary Transfer and Real Property Transfer Taxes, and 2) Transaction and Use Tax (TUT)/Sales Tax, both of which would procure revenues for the City’s General Fund.

To wrap up their work, the Committee reviewed community survey results and formulated recommendations for the Council’s consideration. To address the funding gap for infrastructure repairs, the Study Committee recommended:

- That Council seek voter approval of either (a) imposing a 1% tax on the sale of real property or (b) increasing the sales tax by 1%, for the purpose of funding necessary infrastructure improvements. The Study Committee, by an 8-4 vote, prefers the transfer tax to the sales tax but the Committee unanimously recommends both to the Council for further polling, study, and evaluation to determine which is more likely to gain voter approval.

- That the Council commission an additional voter survey of the two proposed measures to prospective voters in order to determine the degree of voter support for each.

- That the Council target the November 2024 general election ballot for the placement of a tax measure before the voters.

- That the Council consider incorporating guardrails in connection with whatever tax measure is ultimately chosen, including but not limited to those discussed in their report.The Infrastructure Study Committee Report and Recommendation offers further details supporting their recommendations.

At Monday night’s meeting, several Committee members spoke on the options before the Council, providing diverse perspectives on the two tax measures. City Manager Todd Cusimano emphasized the importance of the “360° conversation from the Committee,” for the Council’s decision-making process. “You have really smart, thoughtful comments from the Study Committee,” he said, stressing that hearing different perspectives would help the Council make their decision in upcoming months.

City officials expect pushback on the real estate transfer tax from the Marin Association of Realtors, as MAR CEO Romeo Arrieta told the Marin Independent Journal that a transfer tax would create an additional barrier to buying or selling a home by making it less affordable. “I’m sure you can imagine the Marin Association of Realtors has some thoughts about a real estate transfer tax,” Arrieta said. “We’re not a huge fan of those. They’re volatile and the burden falls on the small amount of residents.”

Mayor Urban Carmel said he believes that people who do not plan to sell their houses and renters will be in favor of the transfer tax because it would not affect them. He said that, overall, people seemed to understand the importance of this work.

“We’re in a good community that understands the value in investing in infrastructure,” Carmel said. “We need to understand where the community is on these two revenue measures. Ideally, both options would poll over 50%, and then we can have a good dialog about what the correct option is. ”

“This is the biggest thing that we’ve got coming up in the next year,” Carmel said. “If we’re successful in getting the community rallied behind a new tax for bettering infrastructure, it will be one of the most significant measures in Mill Valley’s history.”

City officials plan to commission a second survey, as recommended by the Committee. A Work Plan will be developed, with a return scheduled in early 2024 for the Council to decide on the City’s path forward for infrastructure funding.

“This is the biggest thing that we’ve got coming up in the next year,” Carmel said. “If we’re successful in getting the community rallied behind a new tax for bettering infrastructure, it will be one of the most significant measures in Mill Valley’s history.”