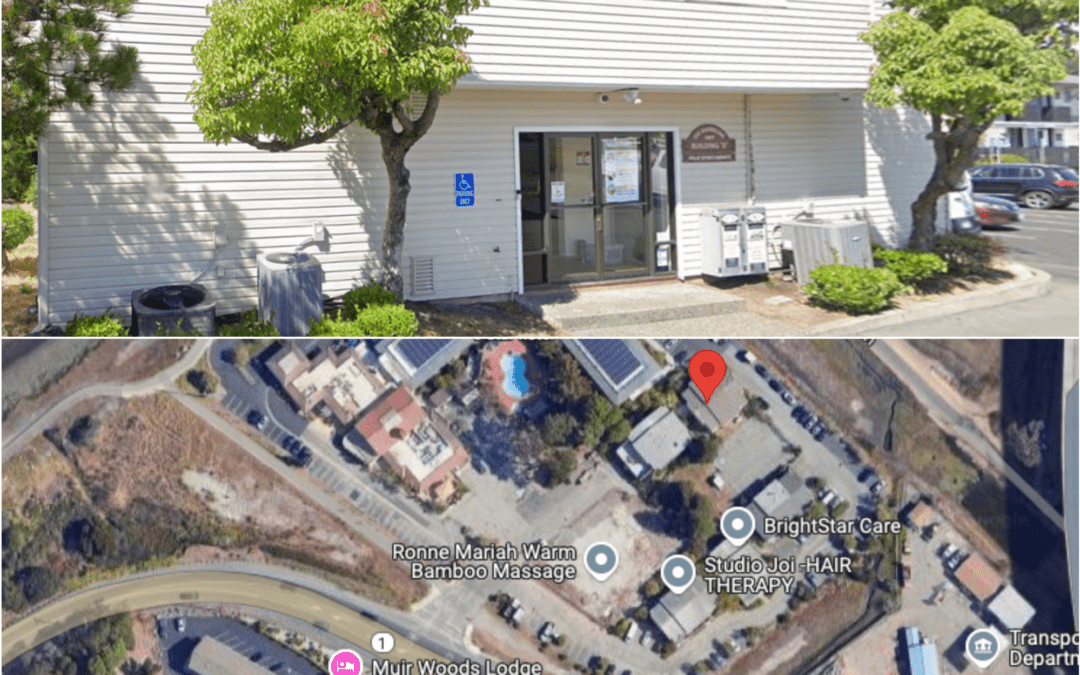

At top left, 150 Shoreline Hwy., one of the two locations, split between the two, of a affordable housing project at 825 Drake Ave. in Marin City and the related project at 150 Shoreline in Tam Valley. 825 Drake is planned for 42 units, and 150 Shoreline Hwy is planned for 32 units.

Per the Marin Independent Journal, a Marin County Superior Court Judge Stephen Freccero has nullified approvals for millions of dollars in tax-exempt bond funding for a proposed apartment building in Marin City, but the developer said the project will move forward. Save Our City, an advocacy group, filed a lawsuit last year to void a 3-2 decision by the Board of Supervisors to approve issuing up to $40 million in bonds to underwrite the 74-apartment project at 825 Drake Ave.

Freccero’s final ruling, issued on Oct. 16, upheld a tentative ruling supporting the advocacy group’s assertion that the supervisors’ decision was invalid because some of them wrongly believed they lacked authority to say no. The supervisors were asked to approve the issuance of the bonds by the California Municipal Finance Authority, or CMFA, a joint powers agency of some 350 California counties, cities and special districts. The authority assists local governments, nonprofits and businesses with the issuance of taxable and tax-exempt financing. Marin County is one of the authority’s members.

Freccero’s final ruling also invalidated the finance authority’s authorization of the bond issuance. The judge said the CMFA lacked proper authority to sign off because of the judge’s nullification of the supervisors’ vote.

In a statement following the final ruling, Save Our City said: “While the ruling does not immediately stop site work on the 825 project, without tax exempt bond access, financing the project is severely hampered going forward.”

According to Jack Chen, a financial expert retained by Save Our City, “the most likely action that Citibank and bond investors would take is to declare Events of Default under the Drake Financing Agreements, terminate those agreements, unwind the structure and seek a return of their capital.” In a declaration submitted to the court at Save Our City’s request, Chen stated that if a foreclosure were to occur, the project also would likely lose $23 million in federal tax credits that it has secured. The developer can sell those tax credits to investors in exchange for cash.

“That isn’t how we see it,” said Caleb Roope, chief executive officer of the Pacific Companies, the project’s developer. “There’s no event of default, and we’re proceeding forward with our project.” Roope said the bonds were issued long ago and purchased by Citibank. He said the ruling has failed to shake Citibank’s confidence in the project.

“Everybody takes for granted that you’re not going to be able to unwind approvals that have already happened,” Roope said. “The ruling doesn’t have an effect on what we’re doing and our ability to proceed.” Roope said his company owns the land in Marin City and has all of the needed approvals.

“Even if our financing was put in jeopardy, it wouldn’t change our ability to be allowed to build the project,” he said. “We could finance it ourselves.”

NOTE: Roope said he intends to honor his commitment to relocate 32 of the apartments planned for Drake Avenue to a half-acre site at 150 Shoreline Highway, which his company purchased for $1.8 million.

Here’s the prior story on the proposed project and related hurdles.

Updates and information about the Marin City project can be found on the 825 Drake webpage. Shoreline Highway project updates and information can also be found online.