The Mill Valley City Council recently voted to move forward on a proposed sales tax increase to the voters in the Nov. 5 election. The measure would raise the 8.25% rate by a percentage point to support city services, facilities maintenance and public safety. The current rate brings in about $3.6 million in annual revenue, according to the city. The tax increase would generate additional $4.2 million.

The Mill Valley City Council recently voted to move forward on a proposed sales tax increase to the voters in the Nov. 5 election. The measure would raise the 8.25% rate by a percentage point to support city services, facilities maintenance and public safety. The current rate brings in about $3.6 million in annual revenue, according to the city. The tax increase would generate additional $4.2 million.

“From the beginning of this process a year ago, my emphasis was on this generation doing what it takes to harden our town for subsequent generations,” Vice Mayor Stephen Burke said. “A new roof on the library is certainly part of that, but it’s the deeper investments we have to make that we haven’t necessarily fully understood the scope of yet.”

“We may feel comfortable at the moment, but this investment is what our generation needs to do on behalf of those who come after us,” he said.

The city needs to come up with $150 million to $180 million for infrastructure updates over the next 10 to 15 years, according to a city committee’s report to the council in December. In March, the council directed staff to move forward with a sales tax increase after receiving favorable polling results. The council voted in June to place the measure on the ballot. On Monday, it passed a resolution endorsing the measure.

Mill Valley Mayor Urban Carmel and City Manager Todd Cusimano discuss the City’s financial health and future infrastructure needs, with appearances from members of the City’s advisory panel.

Related Documents

- Sales Tax Measure 2-page Executive Summary

- Full Text of the Sales Tax Ordinance

- Important Dates, Argument and Rebuttal Information: County of Marin August & November Measure Guide

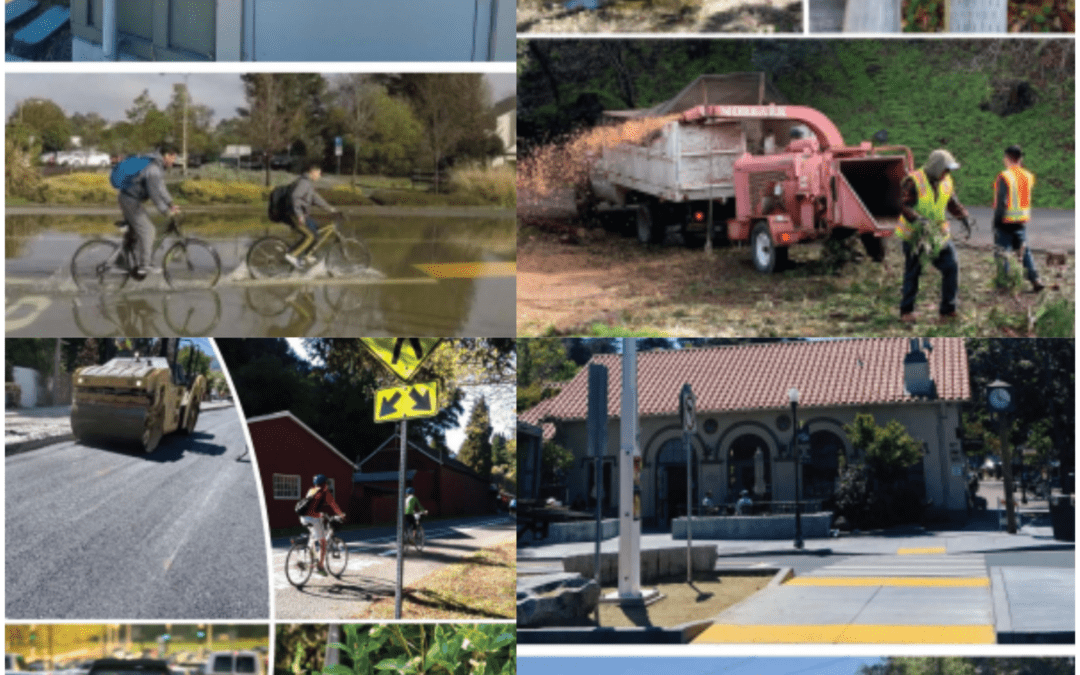

The Council directed that revenue from the sales tax could only be spent on critical infrastructure improvements. This includes work on wildfire prevention measures; landslide prevention; evacuation and emergency preparedness; and maintenance of streets, sidewalks, storm drains and facilities. An independent committee would oversee the spending, and the tax would be set to expire in 10 years.

“These funds, as part of the guardrail, can technically be used for anything, and so we really want to outline this council’s intent with what we’re trying to do,” Cusimano said. “We think we met that with this resolution.” Carmel emphasized that the revenue from the sales tax is meant to add to existing service levels, not replace them.

“That’s really an important thing,” Carmel said. “One of the things that was highlighted to us is the risk of saying, hey, here’s a new tax, and that money goes in to be expended to improve, for example, fuel load reduction or landslide mitigation, and it displaces existing funds that then get diverted someplace else. That’s not the intention. These are meant to improve the service levels. They are meant to be additive, not substitutes for each other.”

The city also needs to address deferred maintenance — heating, ventilating, and air-conditioning systems, roof repairs and access improvements — in its eight civic buildings. The list of projects also includes upgrading community resources like the library, pedestrian walkways, bike lanes, playgrounds and recreational facilities.

“It’s not that we haven’t done anything to our facilities,” Cusimano said. “We’ve done our best to maintain them, as you know, but again it’s expensive and there’s been deferred maintenance because we haven’t been able to do everything that we want and that’s one of the reasons we’re doing this measure.”

The deadline to file an argument against the measure is Aug. 16. Various city committees and commissions will be considering a letter of support for the measure in upcoming meetings.