The Mill Valley City Council agreed last week to seek voter approval of an effort to pass a 1% Sales Tax increase ballot measure in November to establish a dependable source of local funding for crucial City services and facilities over the next 10-15 years.

The Mill Valley City Council agreed last week to seek voter approval of an effort to pass a 1% Sales Tax increase ballot measure in November to establish a dependable source of local funding for crucial City services and facilities over the next 10-15 years.

That decision came on the heels of city efforts to fund its massive, long-term infrastructure needs via a Transfer and Real Property Transfer Tax – an effort whose polling ultimately didn’t meet the necessary support to pass via a EMC Research survey of likely voters. As a result, City of Mill Valley officials pivoted to the sales tax increase.

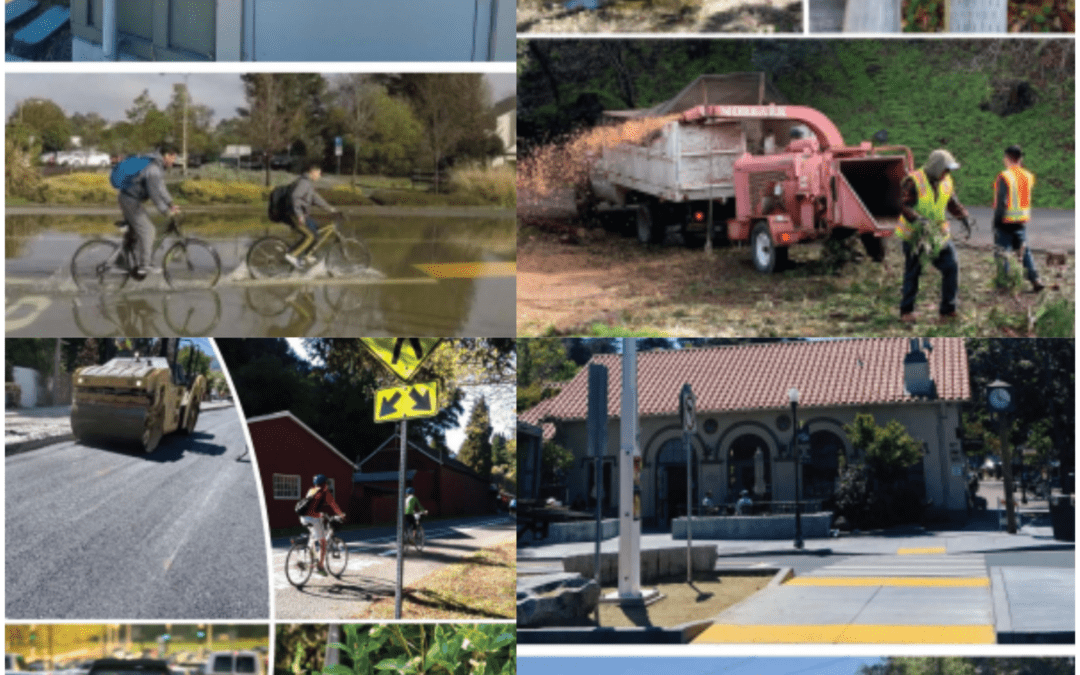

The total, long-term needs are $150 million to $180 million in the next 10-15 years,” city officials indicated, noting that the city’s seeks to “maintain city services and facilities, including: wildfire prevention and public safety; roads, bridges, and emergency routes; storm drains; library, recreation, and parks, and general government use.”

The staff report for the Council in December 2023 couldn’t have been stark: “Our City’s infrastructure is at risk for significant decline within the next 15 years. How will the City secure funding to address needs such as minimizing the risk of wildfires, repairing and maintaining local streets, roads, parks, and facilities, and addressing flooding issues in order to improve sustainability, emergency preparedness, and accessibility? These are issues facing every municipality in the Bay Area and beyond, and city officials appear determined to get out in front of it.”

“This is about the force multipliers,” City Manager Todd Cusimano said. “When we tell our story, the work done by prior councils and staff sets us up for success and it is, quite frankly, what separates us from other towns. (That work) is what separates us and gives us the opportunity to attack this (infrastructure work).

“But if we don’t do anything – fire, landslide and flood risks, what is the cost to do the work? You can double or triple those costs by not doing anything if you take it straight out of our General Fund. Once you hit that tipping scale, you can’t come back.”

“We’re in a good community that understands the value in investing in infrastructure,” Carmel said. “This is the biggest thing that we’ve got coming up in the next year. If we’re successful in getting the community behind an infrastructure ballot measure, it will be one of the most significant measures in Mill Valley’s history.”

Marin Independent Journal columnist Dick Spotswood has put that effort into a broader context.

This November the Bay Area, including Marin, may be facing a “tax tsunami.” Spotswood wrote. “Within the next 30 days, council members, school trustees and regional agency directors must decide if this November’s ballot is the right time to successfully schedule tax measures.”

“The largest item on November’s ballot is a $10 to 20 billion regional bond that, if passed, promises to create 45,000 affordable homes in the nine-county Bay Area,” he wrote. “It’s sponsored by the Metropolitan Transportation Commission’s Bay Area Housing Finance Agency. BAHFA reports that “a $10 billion bond would require a tax of $10.26 per $100,000 in assessed value – or about $100 per year for a million-dollar home.” Double that if the bond is for $20 billion.”

Spotswood writes that “BAHFA’s proposal is the most practical method with the least negative impact to facilitate affordable housing. This effort rightly focuses exclusively on the affordable sector. Of those, Marin has at least 1,173 “below market rate units” now ready to go forward that’ll benefit. This regional measure requires a two-thirds supermajority for passage. State legislators are cynically attempting to reduce that threshold to a more easily achieved 55% through a proposed Assembly Constitutional Amendment 1. If passed, it will decrease that two-thirds supermajority for BAHFA’s bond and future regional measures.”

It was expected that a regional transportation tax to bail out the Bay Area Rapid Transit District and San Francisco’s Municipal Railway would be up in November. While that vote is delayed until 2026, Senate President pro Tempore Mike McGuire, who represents Marin, Sonoma and the North Coast, used his newly won clout to exclude Marin and Sonoma counties from the taxation zone.

He did that to aid the Sonoma-Marin Area Rapid Transit District. It is highly unlikely that North Bay voters would OK both a SMART sales tax extension and another to save “big city” transit. SMART’s one-quarter-cent sales tax, which funds its passenger operations, expires in 2029. The rail district needs to place a measure on the Marin-Sonoma ballot either in 2024 or, more likely, in 2026.

Central and southern Marin’s Tamalpais Union High School District will be back in November with a revamped facilities bond. It will either be a $440 million or $289 million plan. Its last effort, Measure A, a $517 million bond, lost. School trustees’ hope is that this time limiting the project to only top priority projects will persuade skeptical Marinites to vote yes.