To better understand how dig out from the economic rubble of the past year, Keep Marin Working (KMW), a collaboration of business and economic development organizations, including

the North Bay Leadership Council, Marin Realtors Association, Marin Economic Forum, Hispanic Chamber of Commerce of Marin and San Rafael Chamber of Commerce, among others, drafted and distributed a countywide survey of businesses to measure the financial impacts of COVID-19 on our local businesses.The survey

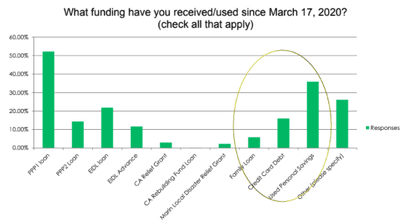

polled nearly 1,200 Marin business owners and paints a stark picture of major financial struggle for businesses across Marin. Of the participating businesses, more than 76% saw a decline in revenue, inciting much concern about financial security and economic stability and not knowing how long they can survive. In fact, 58% said they are using their personal savings, accumulating credit card debt or borrowing from family members just to stay in business. Almost 70% of respondents stated their business decreased by 10% or more with 35% stating revenues were down between 50-100%.Given the illuminating survey results, the Keep Marin Working

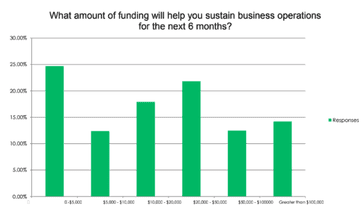

group concluded that another county-wide business relief grant program is necessary. It is estimated that if the program was funded up to $2,000,000, the county could provide immediate relief to save our local businesses and many jobs. This would drive a quicker economic recovery that would benefit all of Marin. However, we need more than a program that provides immediate relief; we need a program that provides ongoing support until the effects of the COVID-19 pandemic have dissipated. “I was surprised by the number of people putting their debt on credit cards,” North Bay Leadership Council CEO Cynthia Murray told the Marin Independent Journal. “Those are last-resort situations. We think about money for keeping doors open, but if there isn’t assistance to help them pay their debt, these businesses won’t be able to stay open.”

The Keep Marin Working group is advocating for a new County of Marin program built on at least $2 million in funding to provide grants to small businesses. “We want to avoid bankruptcy,” Webster said. “For these smaller businesses, if they declare bankruptcy or go out of businesses, that really creates problems in our downtowns and on our main streets. We want to avoid blight.”

“The anxiety is still there,” Webster said, “and the uncertainty is still there.”

“Now is the time for the county and cities to put some energy into rebuilding their local economies, suspending or postponing costly municipal fees, helping local businesses rebound from severe losses and helping those businesses put people back to work, the Marin Independent Journal wrote in an editorial last week.